Distribute rewards and samples at scale

with accountability and user data integrity

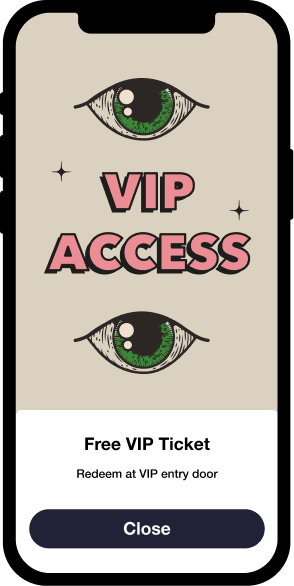

Reward users’ loyalty and purchase behavior with digital Access, Upgrades, Tokens, Promo Balance (similar to Cashback)

Distribute rewards and samples at scale

with accountability and user data integrity

Reward users loyalty and purchase behavior with digital Access, Upgrades, Tokens, Promo Balance (similar to Cashback)

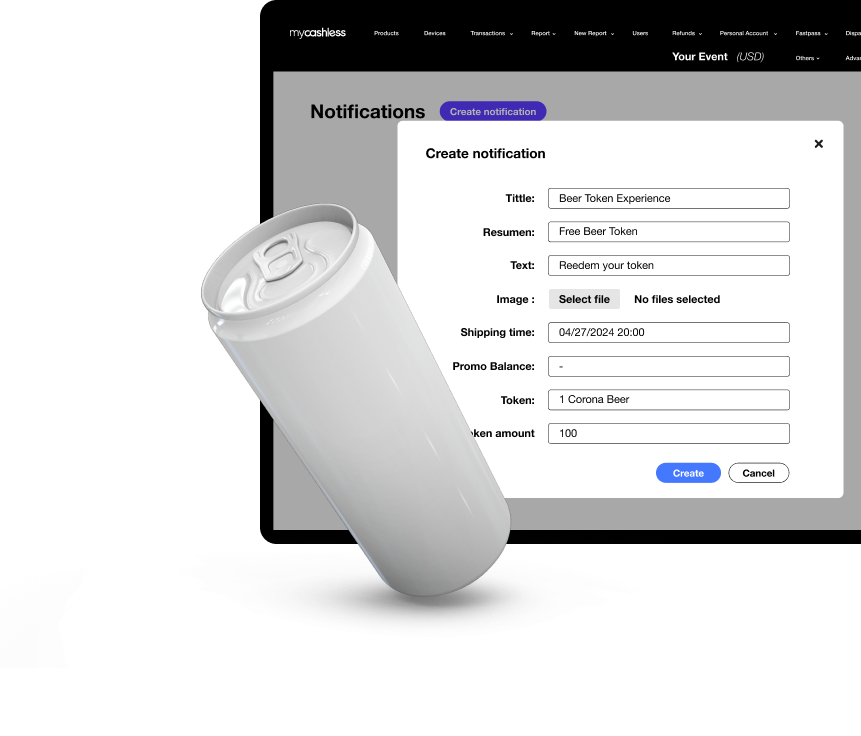

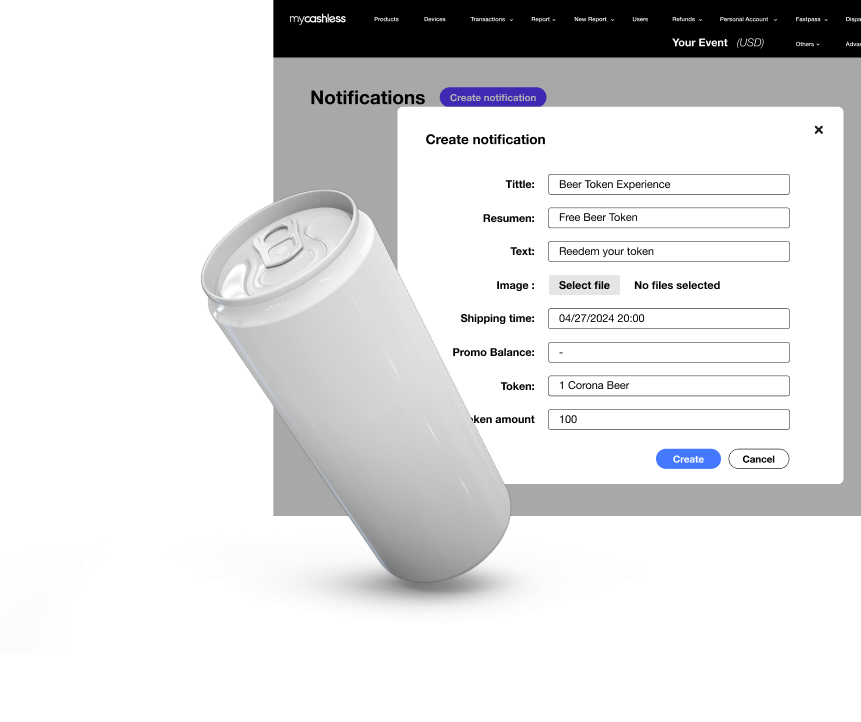

Digital Tokens Capabilities

Allocate rewards and samplings

based on personalized desired actions

Trigger viral promos

like Uber's "Give 100 get 100"

Distribute rewards at scale

with transparency and without connectivity

Gain market intelligence

with sample pre and post purchase behavior

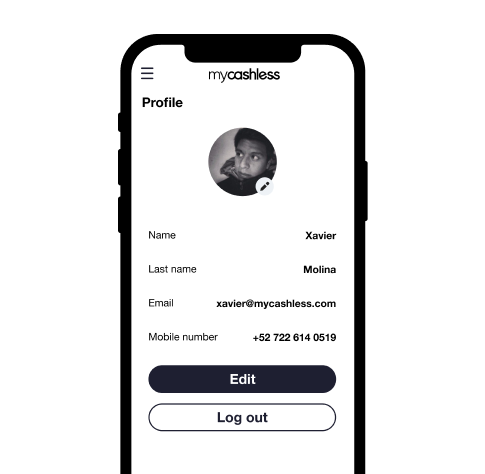

Collect users' data

acknowledging the receipt of rewards

Expand redemption points

by seamlessly integrating convenience stores without additional hardware

Track performance

per staff in real-time

Pains

Rewards distribution

without accountability

No user data

Reloading queues

Hardware intensive

self-serve kiosks

Refunding

Internet dependency to transact

Gains

Digital rewards

distributed as Access, Upgrades, Tokens,

and/or Promo Balance (similar to Cashback)

Utmost control

Market intelligence

Users data

(frequency, spending, favorite products, virality)

Facilitating incentive allocation is now simplified, ensuring absolute transparency in the distribution,

with users readily acknowledging the receipt of rewards tied to their purchase behavior. mycashless digital Access, Upgrades, Tokens, and Promo Balance allow leveraging assets to reward users’ loyalty, triggered by personalized desired actions

Learn how to make the most of it

FAQ’s

Organizers keep money always in their hands. Whether collected online or onsite, mycashless is your auto-auditing system to keep things in place and flowing, without mycashless ever touching your money. For online revenue we recommend using Stripe, having all debit/credit card charges go straight to you. And for onsite revenue you can use any debit/credit card reading machines like Square or similar and including 100% of guests by also accepting cash for balance reloads. A human cashier can collect payments and add balance to guests wristbands with two taps and/or digital chip Apps with two QR scans. While some of our lovely clients have preferred to operate without reload stations as well as without wristbands, thus forcing users successfully to have the digital chip App to enjoy fast service, we do recommend you setup at couple reload stations and mobile reloaders and sell wristbands to guests who may not have a working mobile phone to transact.

While mycashless does not require internet connectivity for users to transact, whether using NFC wristbands or the mycashless User dChip App, we recommend you have internet connectivity setup for your debit/credit card reading terminals. Additionally, some signals can help you get better real time visibility of what you have sold per area, per vendor, per product, and even per guest during your operation or event. Though it isn’t fully required if you are operating in the jungle or the desert, you can synchronize devices to the cloud once the signal is available and all transaction data will be stored within the operator’s mobile devices.

While all integrations are possible, no integrations are needed to implement mycashless successfully and measure its impact within your operation. Though many clients have taken advantage of mycashless APIs to feed their own repositories with collected user data tied to purchase behavior

Organizers keep money always in their hands. Whether collected online or onsite, mycashless is your auto-auditing system to keep things in place and flowing, without mycashless ever touching your money. For online revenue we recommend using Stripe, having all debit/credit card charges go straight to you. And for onsite revenue you can use any debit/credit card reading machines like Square or similar and including 100% of guests by also accepting cash for balance reloads. A human cashier can collect payments and add balance to guests wristbands with two taps and/or digital chip Apps with two QR scans. While some of our lovely clients have preferred to operate without reload stations as well as without wristbands, thus forcing users successfully to have the digital chip App to enjoy fast service, we do recommend you setup at couple reload stations and mobile reloaders and sell wristbands to guests who may not have a working mobile phone to transact.

While mycashless does not require internet connectivity for users to transact, whether using NFC wristbands or the mycashless User dChip App, we recommend you have internet connectivity setup for your debit/credit card reading terminals. Additionally, some signals can help you get better real time visibility of what you have sold per area, per vendor, per product, and even per guest during your operation or event. Though it isn’t fully required if you are operating in the jungle or the desert, you can synchronize devices to the cloud once the signal is available and all transaction data will be stored within the operator’s mobile devices.

While all integrations are possible, no integrations are needed to implement mycashless successfully and measure its impact within your operation. Though many clients have taken advantage of mycashless APIs to feed their own repositories with collected user data tied to purchase behavior