Handle Payments Like a Pro

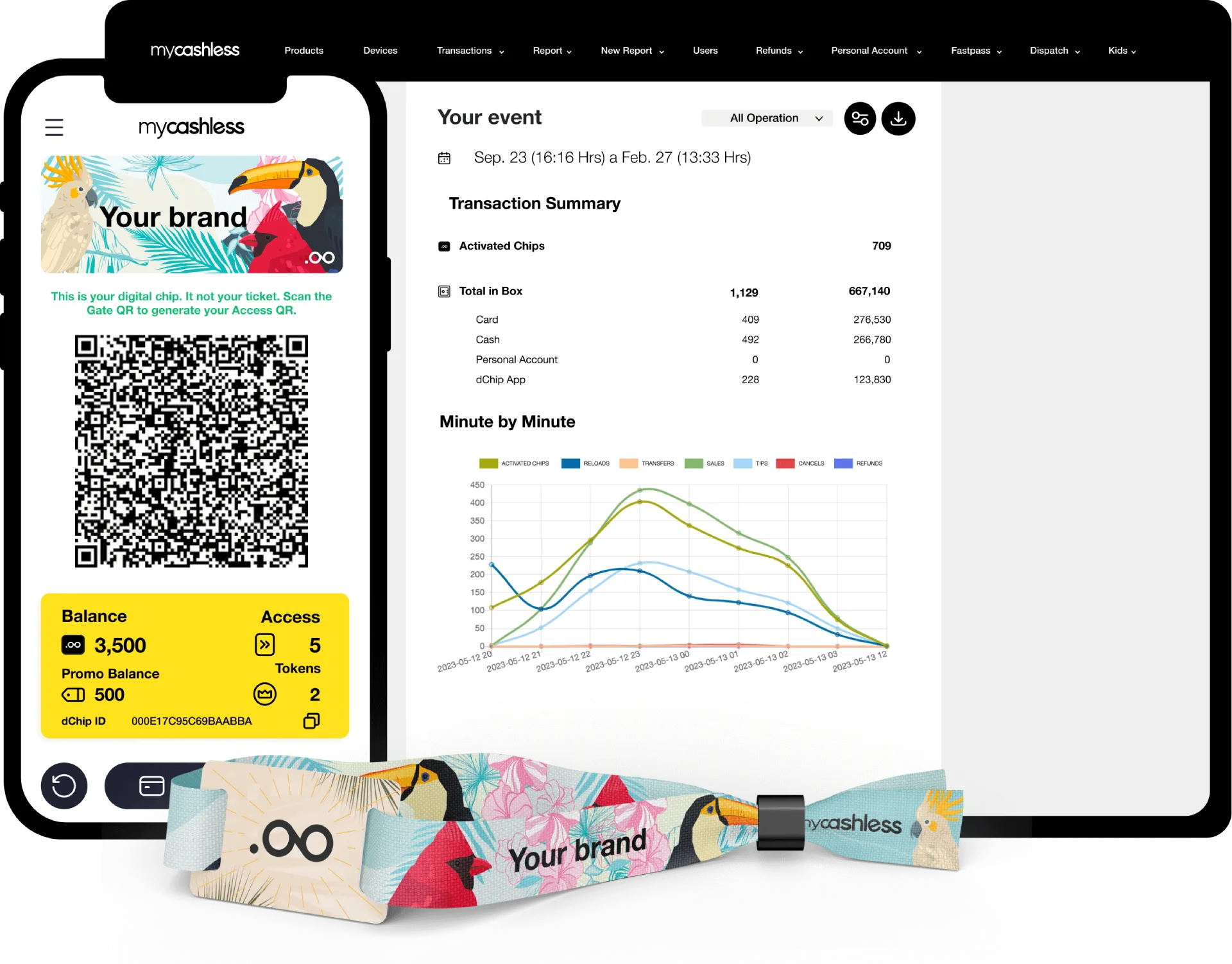

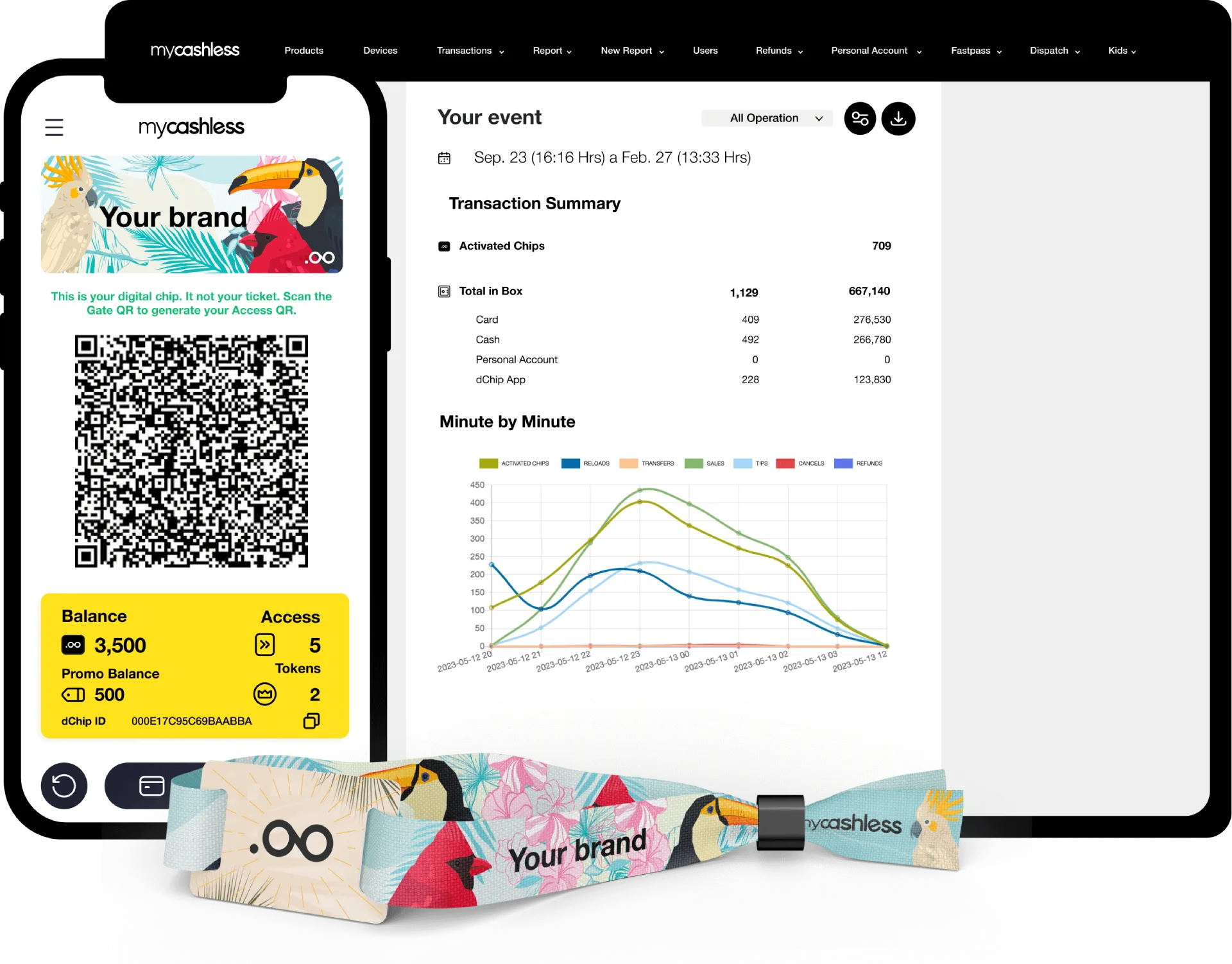

An Easy, Secure Solution for Cashless® Payments, Access, and Upgrades, Online or Offline, with or without Wristbands.

+2,000 events in 15 countries are enjoying speed, transparency and control; increasing revenue by 35% or more (up to 210%)

Handle Payments Like a Pro

An Easy, Secure Solution for Cashless® Payments and Access, Online or Offline, with or without Wristbands.

mycashless partners with leading-edge, sustainable, and progressive event communities

Capture more revenue and gain deep insights into attendee behavior, preferences, and spending patterns.

Simplicity

Transparency

Agility

Control

No internet required

Guaranteeing speed at any scale

Guests spend more

100% adoption = everyone uses it

Service is much faster

Reducing lines = enjoying more

Money is auto-audited

In-App and at reload stations

Maximize the guest experience with data

Separate and simplify everyone’s tasks (vendors, cashiers, hosts)

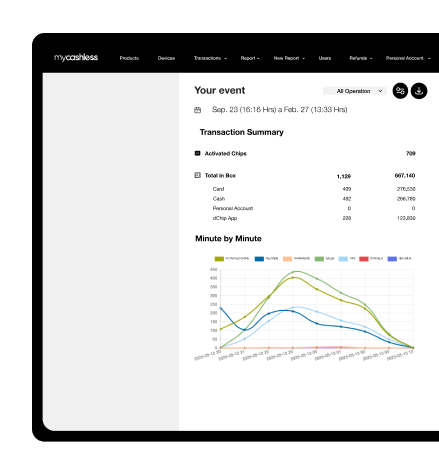

Build trust granting access to reliable reports on cash, cards, products, tokens, and accesses

Achievements

mycashless works in all challenging environments, including those with saturated, little or no connectivity

Focus on creating your best

Challenge accepted

mycashless addresses your operational challenges

No collection of

customer data with spending patterns

Tired of collecting data that requires too much cleansing seeming like a never-ending story?

Start enjoying simple primary data collection with full ownership & comprehensive insights, with complete visibility of purchase and access transactions per area, vendor, product, and user.

Long queues

due to slow

transaction speed

Don't let waiting time compound to the point of bars collapsing.

Enable fast offline transactions, elevating the customer experience while simplifying operational work.

Lack of clarity in total

revenue with long

square-ups

Sending the wrong message with late reports that create uncertainty?

Have money control with transparency, speeding up operators' payments, and unlocking revenue share possibilities by taking away payments from vendors' hands.

Little control with

paper tokens, funny

money or scrip

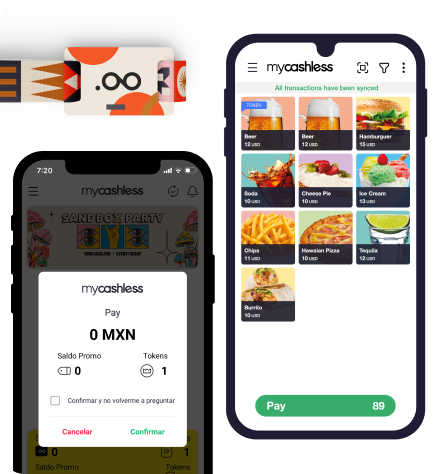

Wondering if the current process is tamper-proof?

With mycashless Digital Instruments for fun, like Promo Balance and Tokens added onto digital and/or NFC chips; stability, security, and transparency are at the core of the experience.

Connectivity glitches slowing down card payments

No need to risk your entire Food and Beverage operation depending on connectivity to transact.

Unlock the power of mycashless Distributed System enabling offline transactions and certainty at any scale, facilitating the acceptance of credit and debit cards at maximum speed.

Too many

processes to get

the work done

Avoid slipping into paralysis analysis.

Facilitate faster decision making with simpler square-ups and real-time reports.

Program triggers based on purchase behaviors and actions automating upselling opportunities.

Cashless® experts welcome

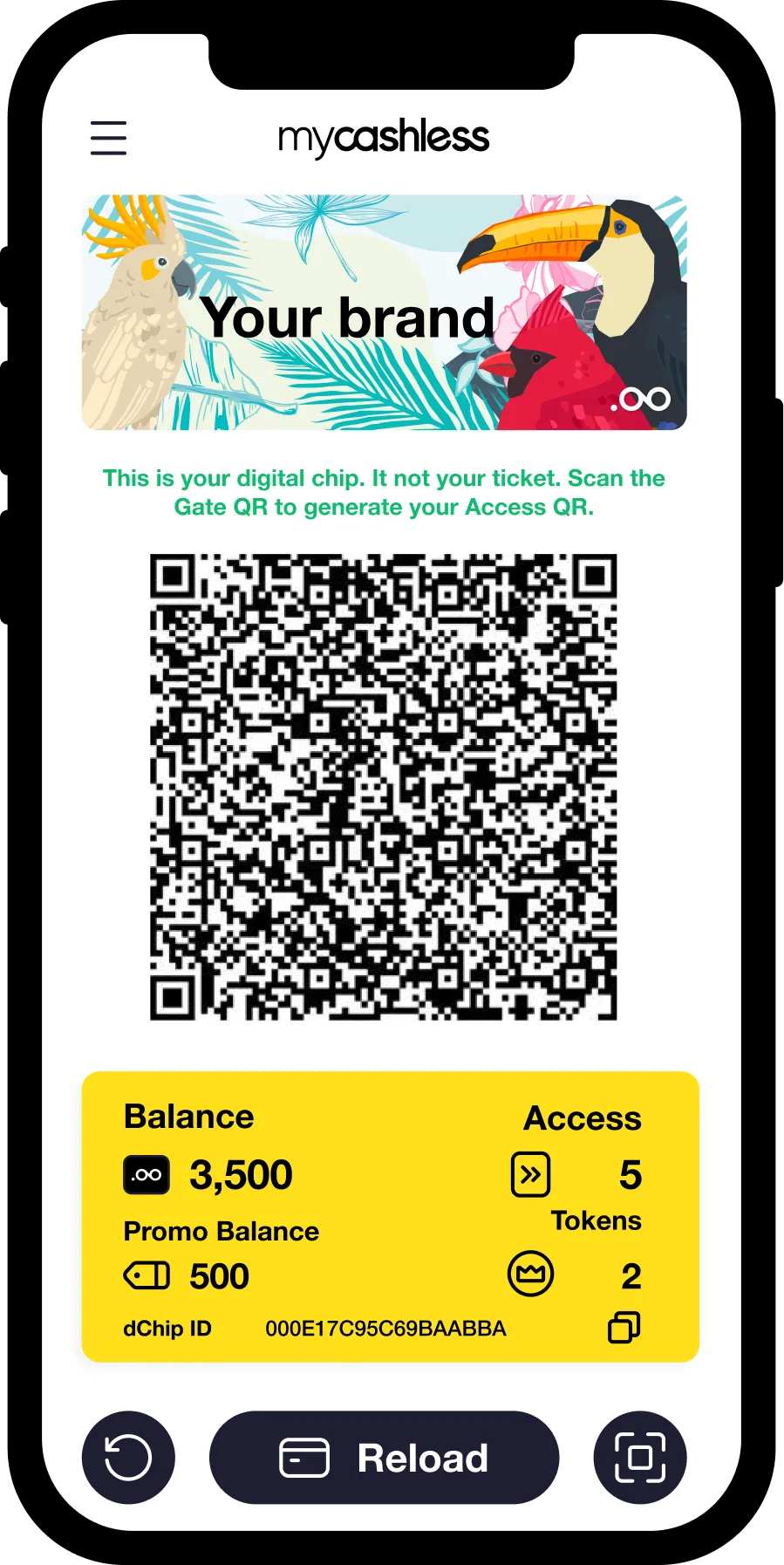

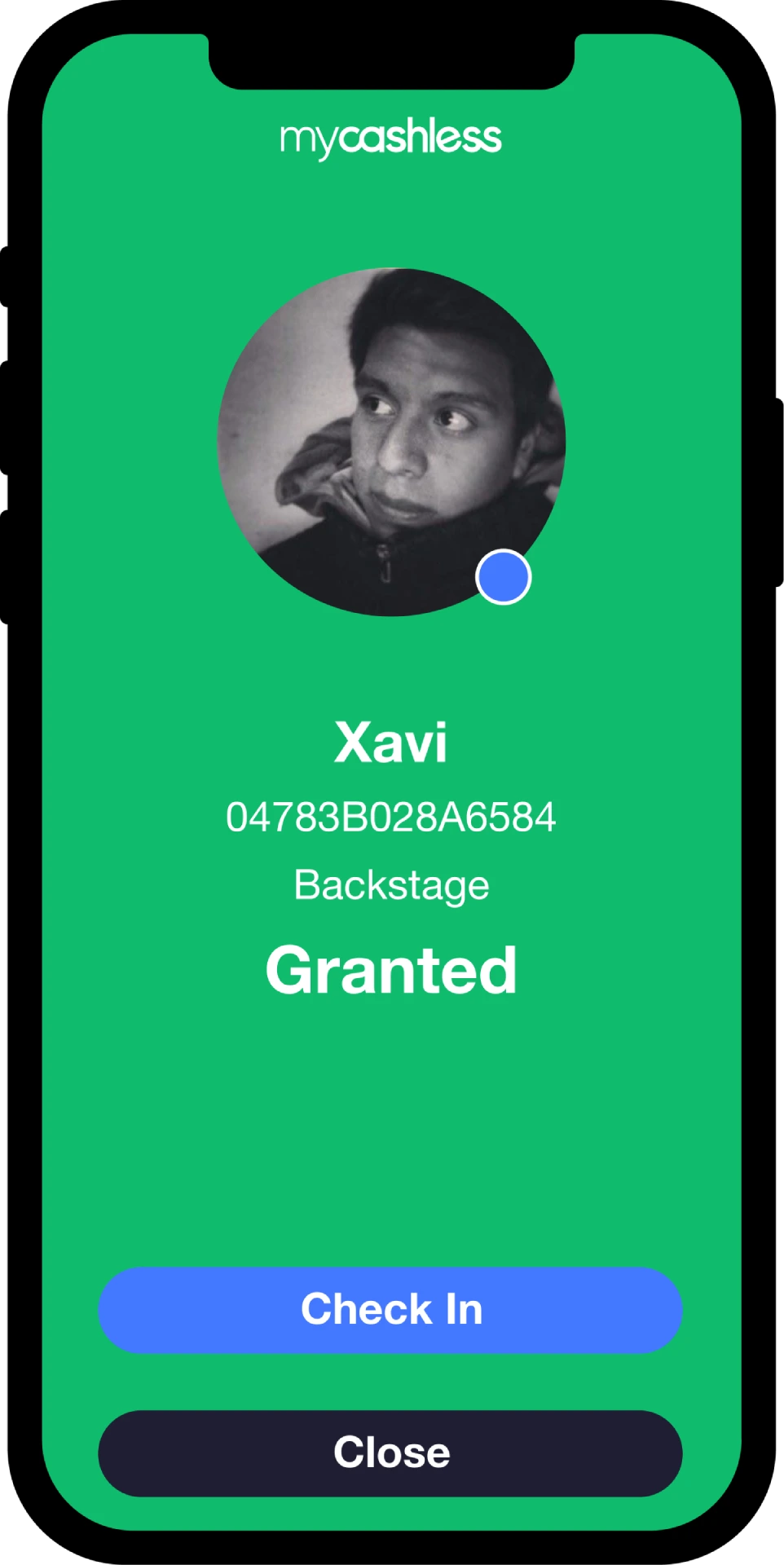

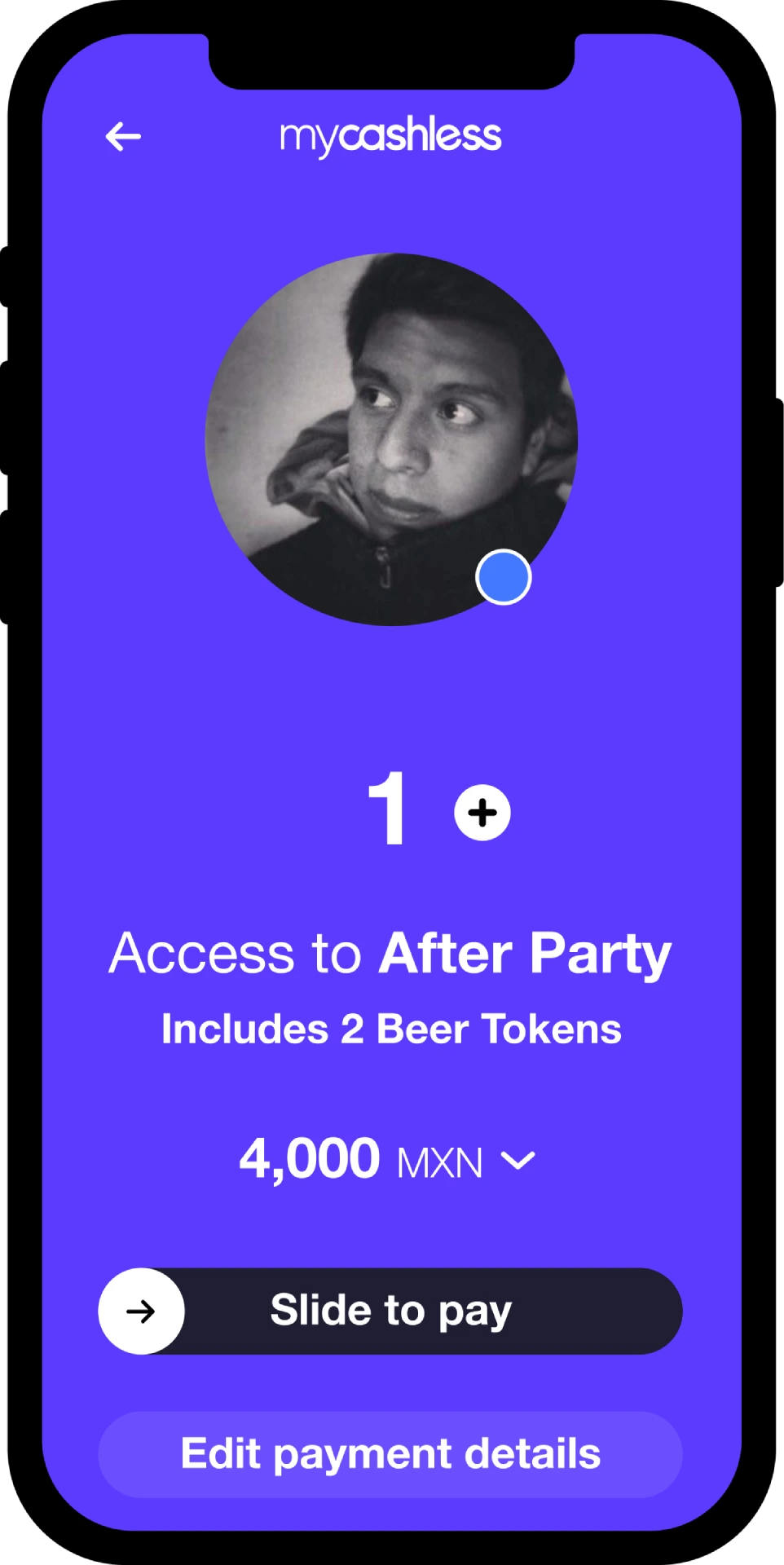

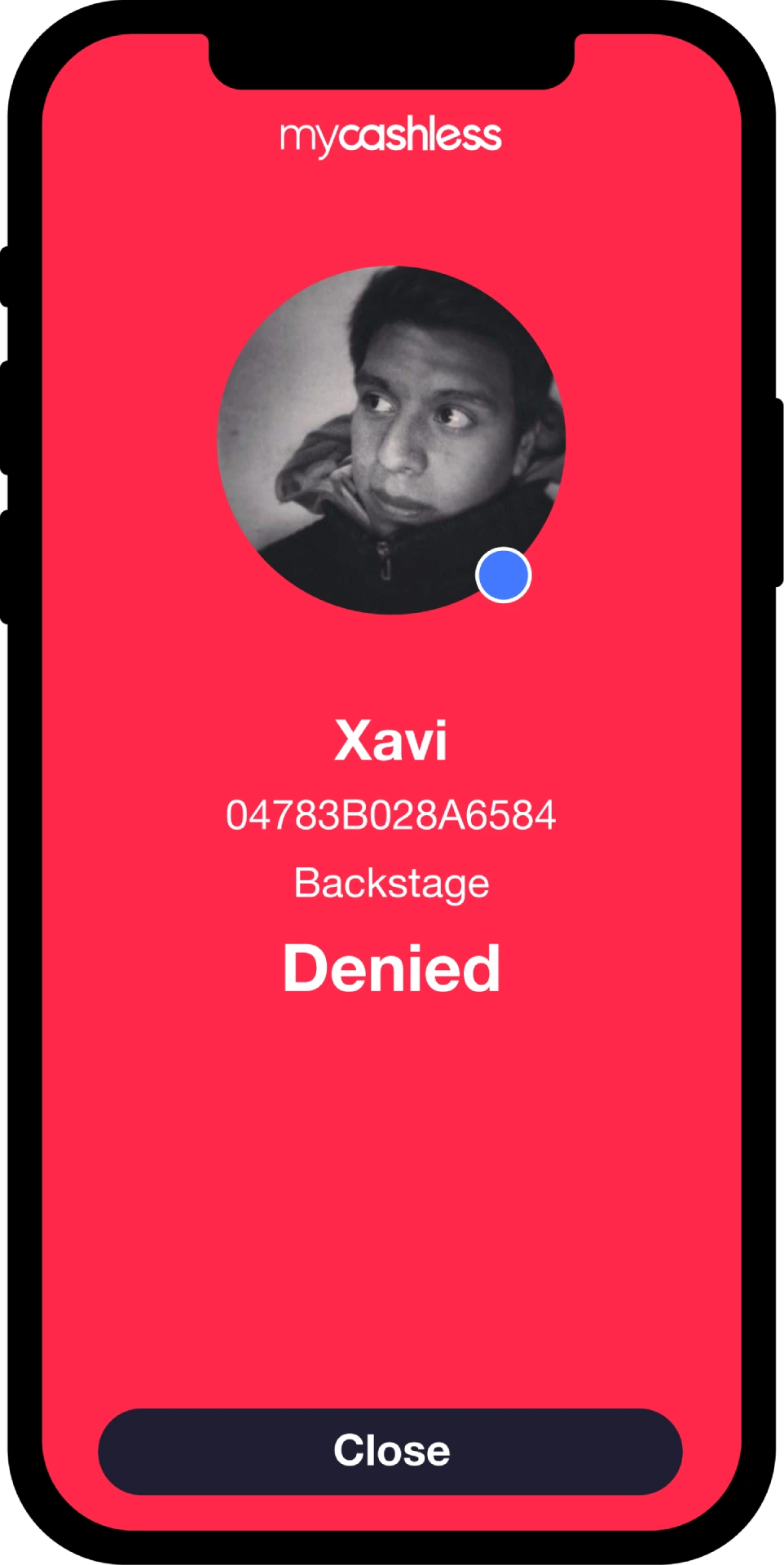

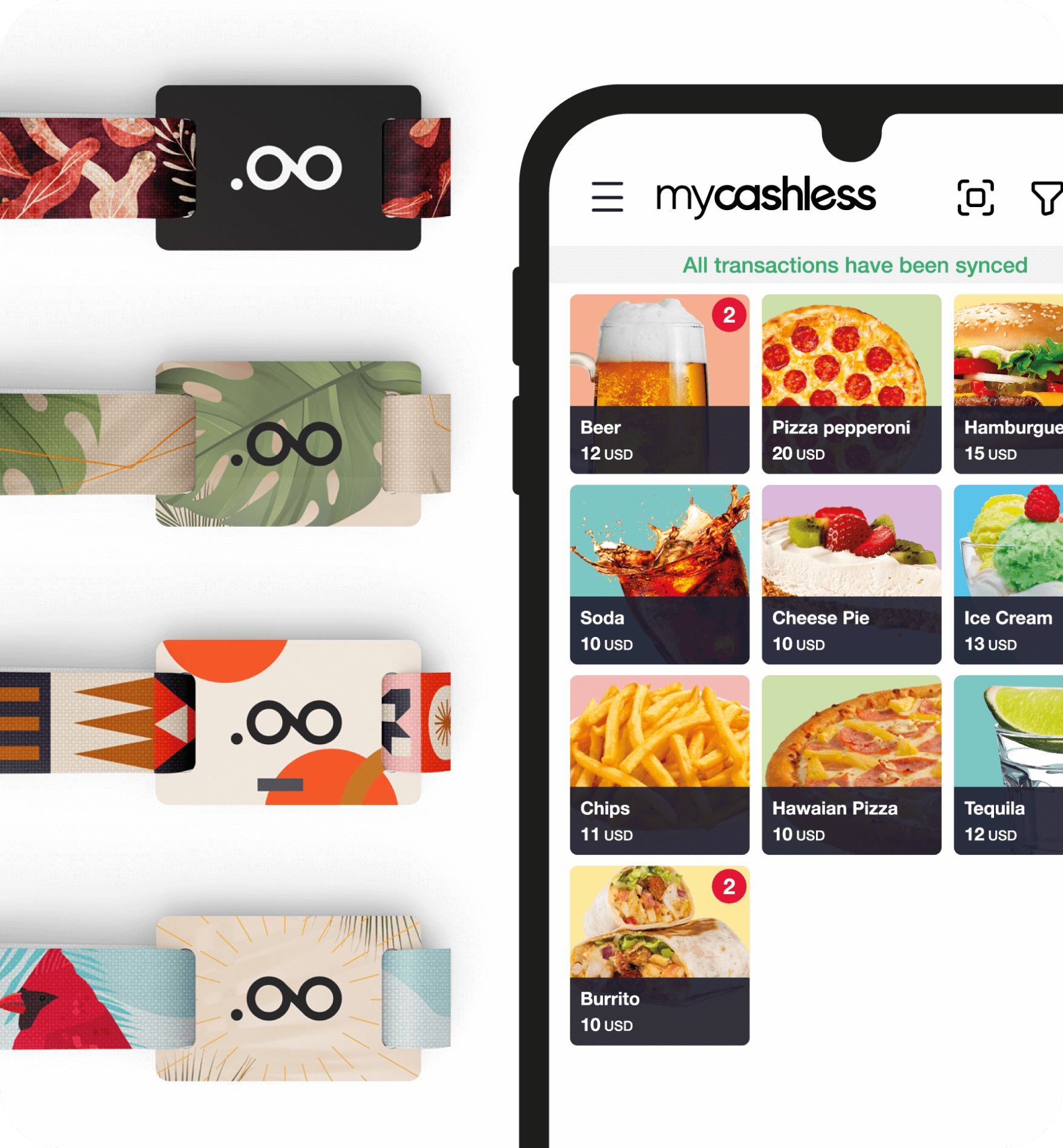

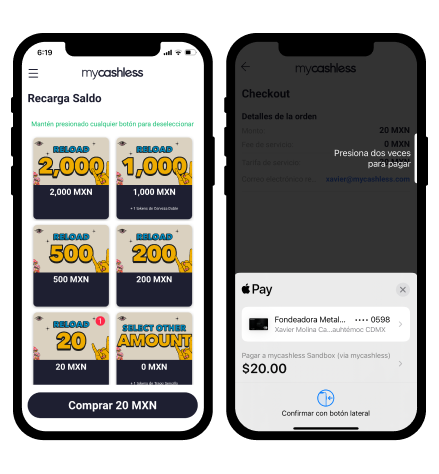

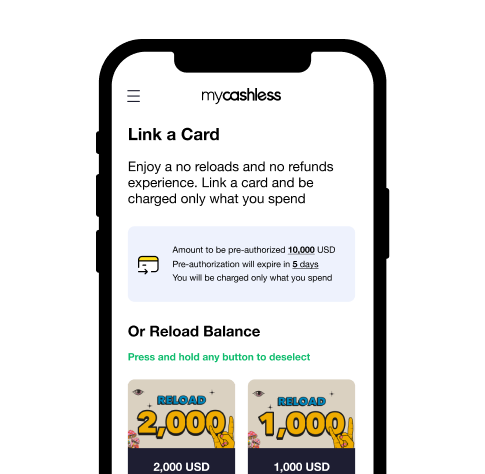

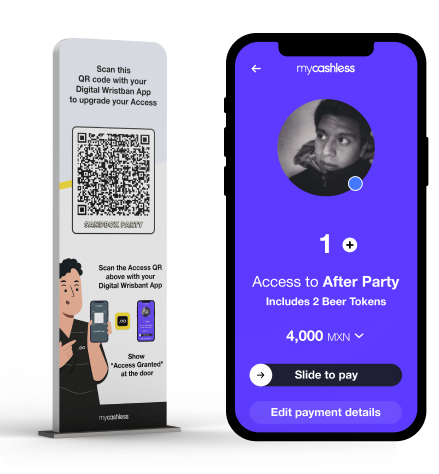

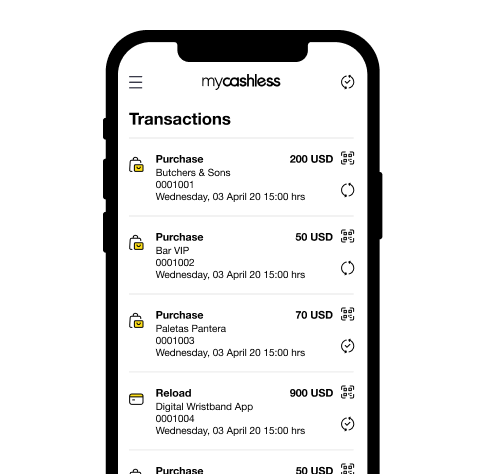

mycashless Digital Wristband App solves your reload, access, and upgrade bottlenecks

It’s been challenging to maintain a loyalty

program

Without consistent app usage, it becomes nearly useless to maintain a loyalty program. But when attendees are all using one App for access and purchases without glitches the magic starts.

Auto-trigger and auto-execute personalized upselling opportunities based on purchase behavior effortlessly.

Reload and upgrade

stations seem like

an extra step

Don’t let upsells slip through the cracks and make the most of your investment by giving attendees an effortless way to get access upgrades and balance purchases.

Attendees use their mycashless Digital Wristband App to navigate their experience with one-tap upgrades on the go.

It is too expensive to implement a cashless solution

Tired of wasting dollars on expensive implementations? Our client's average ROI is 5.7x; even with NFC chips and reloading infrastructure that account for 50% to 70% of implementation costs.

mycashless Digital Wristband App greatly reduces implementation costs, times to reload, and the carbon footprint of your event.

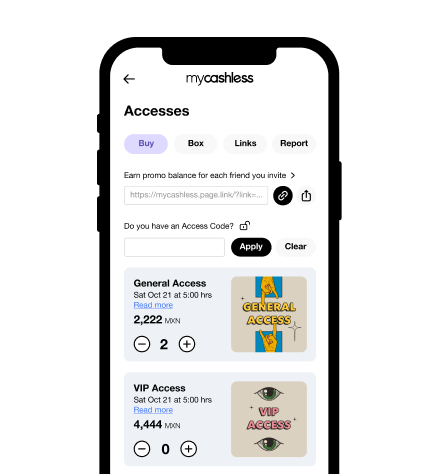

Best Value Ticketing

Web ticketing and tables

Performance with pixels

Access codes

Promo discounts

PR links

Monitor spending by PR

Secure Ticket Transfers

Allow your attendees to transfer tickets to their friends as well as buyback programs

Connect multiple Ticketing Platform(s)

Unify access and purchases all with One App for a seamless fully audited customer experience. Create a hub throughout the mycashless API

A unified experience for multiple-access, purchases, and upgrades without intermittencies

Patent Granted US 11,720,879 B2

A unified experience for multiple-access, purchases, and upgrades without intermittencies

NFC Chips

dChip User App

Onsite play

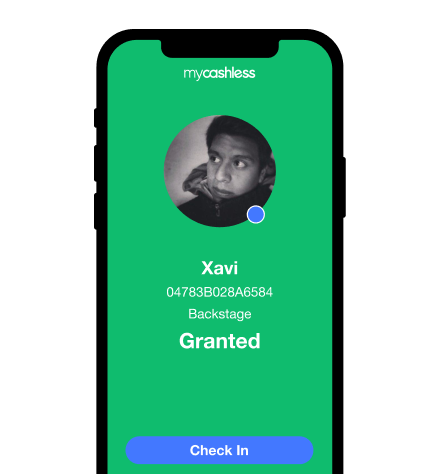

Accesses

Purchases

Upsell with slide-to-pay staffless upgrades

Checkins

Access upgrades

Checkouts

Say goodbye to

connectivity dependency

mycashless

others

Distributed offline transactions

NFC + dChip App (Sync Engine)

Rely on internet connectivity

Increasing infrastructure costs and risks

Peace of mind

Certainty of your process and money

Disintegrated customer experience

from ticketing to onsite spending

Data collection

Light implementation and onboarding

Weighty implementations

Too many NFC chips, stations and staff

Maximizing ROI

5x to 14x average ROI

Not solving the cash issue

As an alternative method of payment

Say goodbye to

connectivity dependency

mycashless

Distributed offline transactions

NFC + dChip App (Sync Engine)

Peace of mind

Certainty of your process and money

Data collection

Light implementation and onboarding

Maximizing ROI

5x to 14x average ROI

others

Rely on internet connectivity

Increasing infrastructure costs and risks

Disintegrated customer experience

from ticketing to onsite spending

Weighty implementations

Too many NFC chips, stations and staff

Not solving the cash issue

As an alternative method of payment

mycashless never holds your money, rather you collect it directly into your Stripe account, bank terminals, and cash boxes.

Transfer the guest service fee (%) to your guests and only pay for additional services when needed.

Your own

Stripe Account

Your own

bank terminals

Your own

Vendors and Cashiers

Your own

Reload Stations

Testimonials

we are thankful for our clients

3 simple steps to master cashless® transactions effortlessly

Say goodbye to the old and slow way of selling and elevate the guest experience with cashless®

Meet the Suite

Cashless®

Maximize revenue and data collection potential,

simplifying payments at the

lowest risk and cost

Digital Wristband App

Revolutionize your cashless® experience

with seamless transactions—no internet, no wristbands, and no reload stations required.

Digital Tokens

Distribute rewards and samples at scale

with accountability and user data integrity

Upgrades

Maximize the FOMO effect by effortlessly enhancing

the experience with additional ticket sales onsite.

Waiters

Enable your waitstaff to provide exceptional service to your customers,

without having to handle payments

Access Control

Ensure the success, safety, and profitability

of your operations while enhancing the overall guest experience

Ticketing

Unleash the potential of consolidating ticket purchases,

entry data, and onsite product transactions into a single platform.

Sync Engine

Prepay and pre-authorize balance mechanisms

that unlock fluent purchase flow at scale

Real Time Reports

Experience peace of mind as your business expands,

with the assurance of a comprehensive audit of financial transactions and product flow

Digitize Funny Money, Drink Tickets, and Scrip at many types of Food and Beverage operations and events with mycashless

Festivals

Parties

Concerts

Stadiums

School

Tournaments

Beach Clubs /

Rooftops / Bars

Brand

Experiences

Markets /

Bazaars

Schools

(Day to Day)

Arenas /

Music Venues

Food Parks /

Food Courts

Theme Parks /

Water Parks

Conferences

Racing

Championships

Sports

Tournaments

Fanzones

Resorts

Fairs

Restaurants

Other

FAQ’s

Organizers keep money always in their hands. Whether collected online or onsite, mycashless is your auto-auditing system to keep things in place and flowing, without mycashless ever touching your money. For online revenue we recommend using Stripe, having all debit/credit card charges go straight to you. And for onsite revenue, you can use any debit/credit card reading machines like Square or similar and including 100% of guests by also accepting cash for balance reloads. A human cashier can collect payments and add balance to guests’ wristbands with two taps and/or digital chip Apps with two QR scans. While some of our lovely clients have preferred to operate without reload stations as well as without wristbands, thus forcing users successfully to have the digital chip App to enjoy fast service, we do recommend you set up a couple of reload stations and mobile reloaders and sell wristbands to guests who may not have a working mobile phone to transact.

While mycashless does not require internet connectivity for users to transact, whether using NFC wristbands or the mycashless User dChip App, we recommend you have internet connectivity setup for your debit/credit card reading terminals. Additionally, some signal can help you get better real time visibility of what you have sold per area, per vendor, per product, and even per guest during your operation or event. Though it isn’t fully required if you are operating in the jungle or the desert, you can synchronize devices to the cloud once the signal is available and all transaction data will be stored within the operator’s mobile devices.

While all integrations are possible, no integrations are needed to implement mycashless successfully and measure its impact within your operation. Though many clients have taken advantage of mycashless APIs to feed their own repositories with collected user data tied to purchase behavior.

Organizers keep money always in their hands. Whether collected online or onsite, mycashless is your auto-auditing system to keep things in place and flowing, without mycashless ever touching your money. For online revenue we recommend using Stripe, having all debit/credit card charges go straight to you. And for onsite revenue, you can use any debit/credit card reading machines like Square or similar and including 100% of guests by also accepting cash for balance reloads. A human cashier can collect payments and add balance to guests’ wristbands with two taps and/or digital chip Apps with two QR scans. While some of our lovely clients have preferred to operate without reload stations as well as without wristbands, thus forcing users successfully to have the digital chip App to enjoy fast service, we do recommend you set up a couple of reload stations and mobile reloaders and sell wristbands to guests who may not have a working mobile phone to transact.

While mycashless does not require internet connectivity for users to transact, whether using NFC wristbands or the mycashless User dChip App, we recommend you have internet connectivity setup for your debit/credit card reading terminals. Additionally, some signal can help you get better real time visibility of what you have sold per area, per vendor, per product, and even per guest during your operation or event. Though it isn’t fully required if you are operating in the jungle or the desert, you can synchronize devices to the cloud once the signal is available and all transaction data will be stored within the operator’s mobile devices.

While all integrations are possible, no integrations are needed to implement mycashless successfully and measure its impact within your operation. Though many clients have taken advantage of mycashless APIs to feed their own repositories with collected user data tied to purchase behavior.