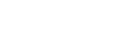

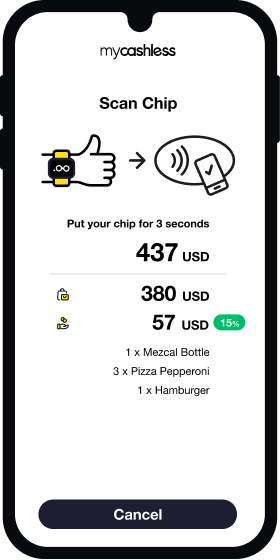

Prepay and pre-authorize balance mechanisms

that unlock fluent purchase flow at scale

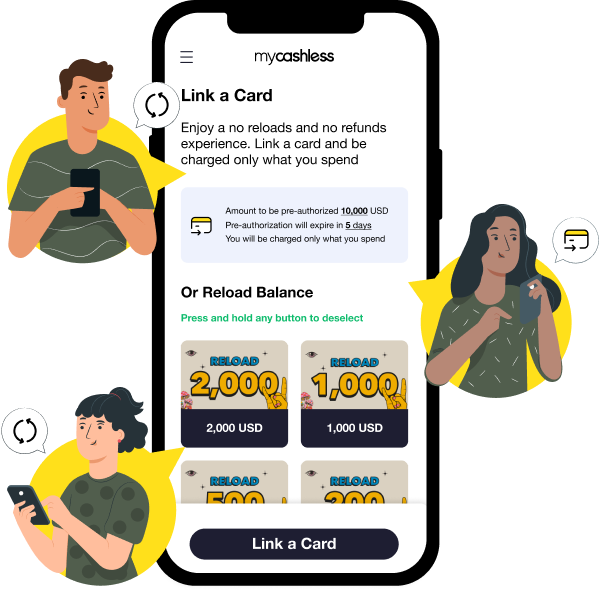

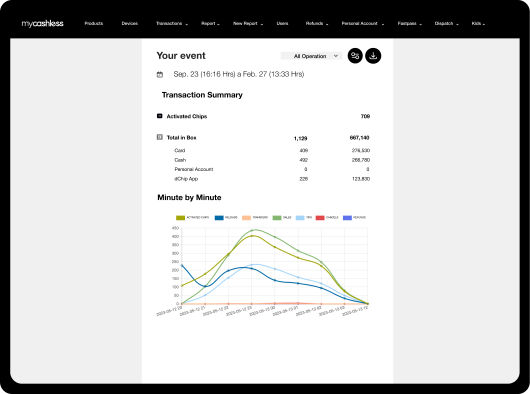

100% of your data with 100% guest inclusion, all transactions by area, vendor, product, and guest; filling the larger gaps with one-tap opportunities

Experience peace of mind as your business expands,

with the assurance of a comprehensive audit of financial transactions and product flow

Uncover valuable insights into your key customers by analyzing their attendance frequency, spending patterns, and influence on group dynamics

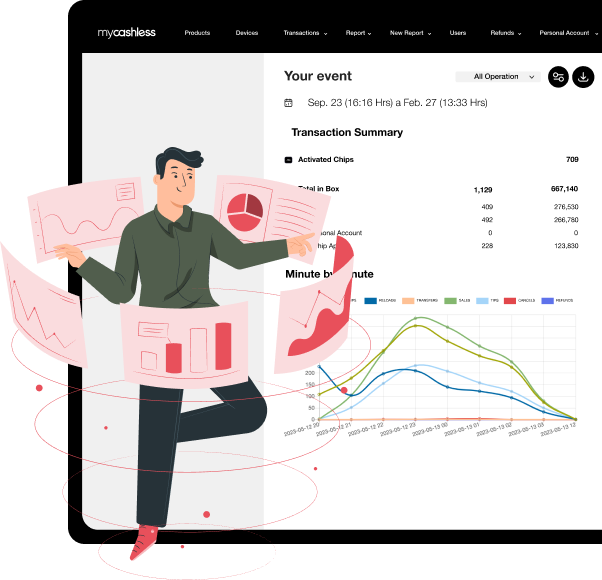

Sync Engine Capabilities

Encrypted

transactions phone-to-phone and

nfc-to-phone-to-nfc

In-person marketplaces

of many kinds fully audited by the owner

Distributed

system unlocking the power of scale

without intermittencies

Simplified money handling

and product handing with full traceability

Secure data storage

locally at each device and centrally

Blocked manipulation of orders

by operating staff

Data shipping

to all cloud services using endpoints

from Connect API

Higher conversion

of user registrations tied to purchase

behavior

Pains

Expense of internet

infrastructure

Risks of connectivity glitches

when sales need to flow

Disintegrated systems

between payments, orders in paper,

data captures, and inventories

Gains

Easy to use App

with or without wristbands

Reliable, fast

transacting engine

Streamlined guest experience

at any scale

Prepay and pre-authorize

balance mechanisms

Asynchronicity

between offline transactions and online reporting

Transparency

of all transactions

Shipping data

with endpoints to any cloud services

Be safe at any size of food

and beverage operation

by relying on a sync engine that ensures transaction data security and efficient purchases without delays, managing server communications asynchronously, and shipping data with endpoints to any cloud services

Learn how to make the most of it

- Waiters

Enable your waitstaff to provide exceptional service to your customers,

without having to handle payments

FAQ’s

When can I expect to get my money?

Organizers keep money always in their hands. Whether collected online or onsite, mycashless is your auto-auditing system to keep things in place and flowing, without mycashless ever touching your money. For online revenue we recommend using Stripe, having all debit/credit card charges go straight to you. And for onsite revenue, you can use any debit/credit card reading machines like Square or similar and including 100% of guests by also accepting cash for balance reloads. A human cashier can collect payments and add balance to guests’ wristbands with two taps and/or digital chip Apps with two QR scans. While some of our lovely clients have preferred to operate without reload stations as well as without wristbands, thus forcing users successfully to have the digital chip App to enjoy fast service, we do recommend you set up a couple of reload stations and mobile reloaders and sell wristbands to guests who may not have a working mobile phone to transact.

What are the internet connectivity requirements?

While mycashless does not require internet connectivity for users to transact, whether using NFC wristbands or the mycashless User dChip App, we recommend you have internet connectivity setup for your debit/credit card reading terminals. Additionally, some signals can help you get better real-time visibility of what you have sold per area, per vendor, per product, and even per guest during your operation or event. Though it isn’t fully required if you are operating in the jungle or the desert, you can synchronize devices to the cloud once the signal is available and all transaction data will be stored within the operator’s mobile devices.

Are integrations possible?

While all integrations are possible. No integrations are needed to implement mycashless successfully and measure its impact within your operation. Though many clients have taken advantage of mycashless APIs to feed their own repositories with collected user data tied to purchase behavior