Experience peace of mind as your business expands,

with the assurance of a comprehensive audit of financial transactions and product flow

Uncover valuable insights into your key customers by analyzing their attendance frequency, spending patterns, and influence on group dynamics

Experience peace of mind as your business expands,

with the assurance of a comprehensive audit of financial transactions and product flow

Uncover valuable insights into your key customers by analyzing their attendance frequency, spending patterns, and influence on group dynamics

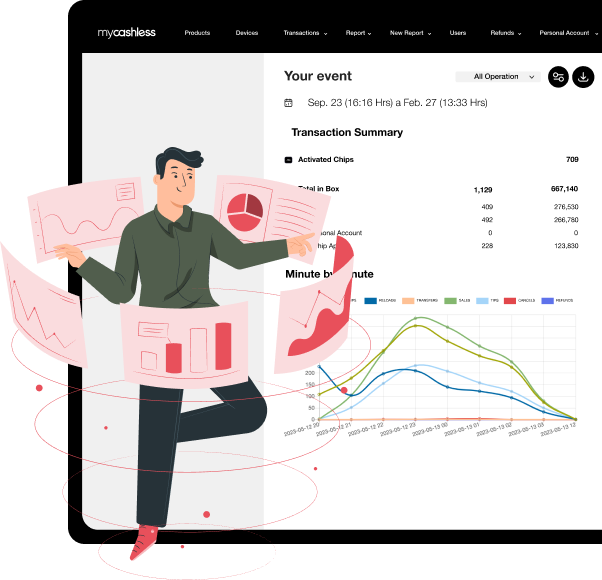

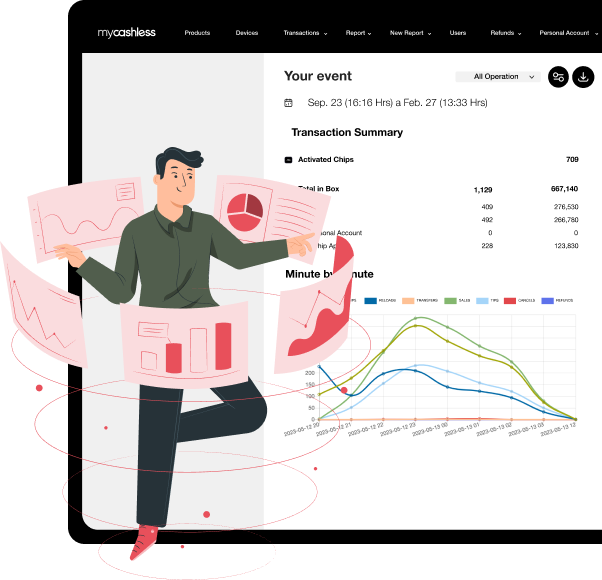

Real-Time Reports Capabilities

In-web self-serve global and per

vendor reporting

utilizing a mobile number, authenticated via

SMS and/or WhatsApp for added security

Transaction speed by vendor

through heat maps to identify areas with

high demand for product flow optimization

Executive summary dashboard reporting

featuring key performance indicators such

as reloads in cards, cash, and mobile app,

sales, refunds, and balance in circulation,

providing a comprehensive overview of your

operations at a glance

Synchronization status by device

to monitor centralized data versus

distributed device data awaiting

synchronization

Real-time sales reporting by

vendor and product,

identifying top and bottom performers for

quick strategic adjustments

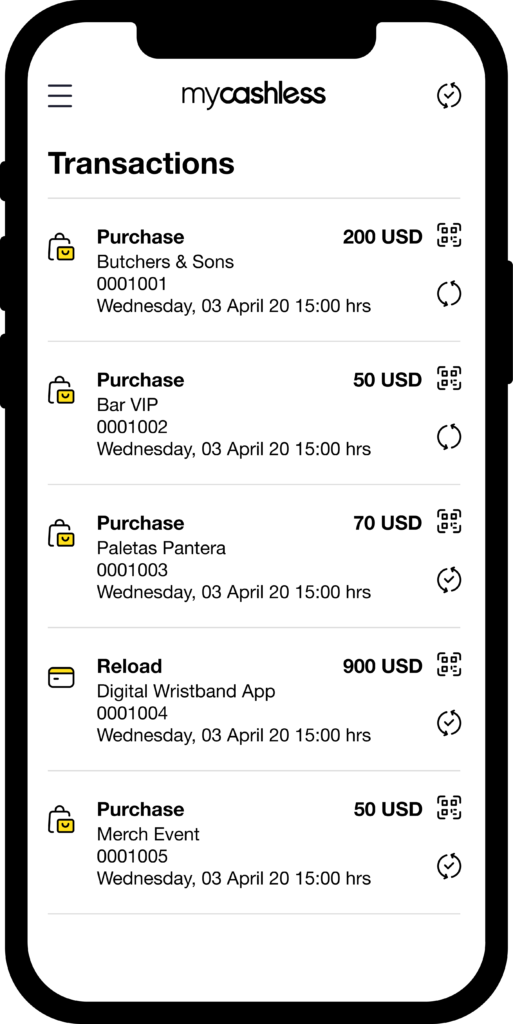

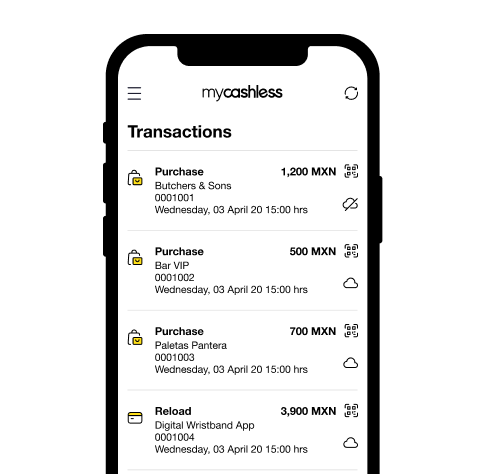

Digital receipts prompting

for each table, user, and transaction,

including reloads, purchases, and refunds

Reporting on top clients and PRs

based on spending and product

preferences, automatically triggering

additional perks to encourage further

engagement and referrals

Export raw data for expanded visualizations

and cross-referencing capabilities enabled

for tenant users (owners only)

Connect API

with data availability on any client server

Pains

Excessive steps

to reconcile numbers

Instinct-based

instant decision-making

Delayed reports

Possibly biased reports

No user data

No digital fallback

Gains

User-friendly login method

for owners and vendors to access and

review sales data

Real-time reports

with synchronized device visibility for data-

driven instant decision-making

Total control

of access capacity, money collection, sales

per vendor, promos and sampling, product

inventories, staff work-times, guests journey,

expired balance, minute by minute, and more

Users data

with frequency of attendance, spending,

favorite products, repeat, virality,

demographics, and more

100% uptime

without reliance on internet connectivity

Provide partners and stakeholders with accurate and transparent reports, guaranteeing a thorough audit of financial transactions and product flow.

With mycashless Real-Time Reports, uncover valuable insights into your key customers by analyzing their attendance frequency, spending patterns, and influence on group behavior

Learn how to make the most of it

- Sync Engine

Prepay and pre-authorize

balance mechanisms

that unlock fluent purchase flow at scale

FAQ’s

Organizers keep money always in their hands. Whether collected online or onsite, mycashless is your auto-auditing system to keep things in place and flowing, without mycashless ever touching your money. For online revenue we recommend using Stripe, having all debit/credit card charges go straight to you. And for onsite revenue, you can use any debit/credit card reading machines like Square or similar and including 100% of guests by also accepting cash for balance reloads. A human cashier can collect payments and add balance to guests’ wristbands with two taps and/or digital chip Apps with two QR scans. While some of our lovely clients have preferred to operate without reload stations as well as without wristbands, thus forcing users successfully to have the digital chip App to enjoy fast service, we do recommend you set up a couple of reload stations and mobile reloaders and sell wristbands to guests who may not have a working mobile phone to transact.

While mycashless does not require internet connectivity for users to transact, whether using NFC wristbands or the mycashless User dChip App, we recommend you have internet connectivity setup for your debit/credit card reading terminals. Additionally, some signals can help you get better real-time visibility of what you have sold per area, per vendor, per product, and even per guest during your operation or event. Though it isn’t fully required if you are operating in the jungle or the desert, you can synchronize devices to the cloud once the signal is available and all transaction data will be stored within the operator’s mobile devices.

While all integrations are possible, no integrations are needed to implement mycashless successfully and measure its impact within your operation. Though many clients have taken advantage of mycashless APIs to feed their own repositories with collected user data tied to purchase behavior

Organizers keep money always in their hands. Whether collected online or onsite, mycashless is your auto-auditing system to keep things in place and flowing, without mycashless ever touching your money. For online revenue we recommend using Stripe, having all debit/credit card charges go straight to you. And for onsite revenue, you can use any debit/credit card reading machines like Square or similar and including 100% of guests by also accepting cash for balance reloads. A human cashier can collect payments and add balance to guests’ wristbands with two taps and/or digital chip Apps with two QR scans. While some of our lovely clients have preferred to operate without reload stations as well as without wristbands, thus forcing users successfully to have the digital chip App to enjoy fast service, we do recommend you set up a couple of reload stations and mobile reloaders and sell wristbands to guests who may not have a working mobile phone to transact.

While mycashless does not require internet connectivity for users to transact, whether using NFC wristbands or the mycashless User dChip App, we recommend you have internet connectivity setup for your debit/credit card reading terminals. Additionally, some signals can help you get better real-time visibility of what you have sold per area, per vendor, per product, and even per guest during your operation or event. Though it isn’t fully required if you are operating in the jungle or the desert, you can synchronize devices to the cloud once the signal is available and all transaction data will be stored within the operator’s mobile devices.

While all integrations are possible, no integrations are needed to implement mycashless successfully and measure its impact within your operation. Though many clients have taken advantage of mycashless APIs to feed their own repositories with collected user data tied to purchase behavior